Tom and Jerry: A Nutcracker Tale is an American direct-to-video animated Christmas fantasy comedy film, released in 2007. The film was produced by Warner Bros. Animation and Turner Entertainment Co., and is the first Tom and Jerry film directed by Spike Brandt and Tony Cervone. A Tale of Two Crowns: COVID-19 and the Return of Crown Preference. Corporate Finance & Restructuring December 1, 2020. COVID-19; Operational; Coronaviruses are named for the crown-like spikes on their surface. The combination of the “Two Crowns” - COVID-19 alongside the return of Crown Preference - will result in a significantly more.

We at Burning Coal Theatre Company are excited to announce that our much delayed London Theatre Tour is ON! In order to make it more comfortable for our travelers, we are offering one of three sets of dates to choose from:

- October 17 – 24, 2021

- October 31 – November 7, 2021

- April 10 – 17, 2022

Join Burning Coal’s artistic director Jerome Davis on a whirlwind tour of all the best theatre experiences available in London, U.K. Together you’ll discover the newest plays, oldest stages, and hear some of Jerome’s wonderful anecdotes.

The tour will include:

- Air Fare to and from London and RDU

- A chartered bus to and from the hotel and airport

- A weekly tube pass

- A room (double occupancy) in a beautiful hotel 2 blocks from a centrally located tube stop for 6 nights, including free Wi-Fi and breakfast (with group discussion each morning)

- Tickets to 6 plays at theatres such as the National Theatre, the Royal Court, The Almeida, the Donmar Warehouse, the Hampstead, the Barbican Center and the West End Read More »

Coronaviruses are named for the crown-like spikes on their surface. The combination of the 'Two Crowns' - COVID-19 alongside the return of Crown Preference - will result in a significantly more material impact than was originally intended, given the COVID-19 VAT deferral scheme which has resulted in over £28bn of cumulative VAT deferrals.

In this briefing memo, Lisa Rickelton (Restructuring) and Alistair Winning (Tax) discuss the practical consequences of Crown Preference, alongside crown set-off rules in the context of insolvency, and provide worked examples, giving a deeper dive into the issues raised by VAT groups in which members have joint and several liability.

Summary of Provisions

The return of Crown Preference had been due to come into force on 6 April 2020; however, this was delayed to 1 December 2020 due to COVID-19.

HMRC will rank ahead of floating charge creditors and unsecured creditors in respect of certain taxes which are collected by a company on behalf of HMRC – primarily VAT, PAYE and employees' National Insurance Contributions ('Priority Taxes'). Prior to 1 December 2020, these taxes rank as unsecured.

Key Points to Note:

- The new waterfall applies to all insolvencies which commence from 1 December 2020 – the date of the creation of the floating charge is irrelevant, unlike the transitional provisions on the increase of the Prescribed Part cap to £800k.

- The existing Schedule 6 preferential (generally employee) creditors will rank ahead of the new Priority Taxes which will have a secondary preferential claim.

- There is no cap on HMRC's secondary preferential claim for Priority Taxes – either by quantum or by time period.

- HMRC will remain an unsecured creditor in respect of taxes that HMRC collects directly e.g. corporation tax, employers' National Insurance.

- These rules are in addition to the existing legal framework which allows HMRC to offset pre-administration credits against pre-administration debts of HMRC or other government departments under Crown Set-off.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Employee Retention Tax Credit Can Significantly Reduce Employer Payroll Taxes Federal Income Tax Rate Proposals

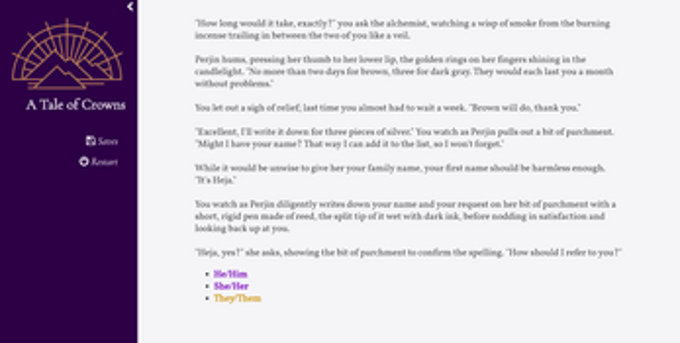

Federal Income Tax Rate ProposalsA Tale Of Crowns

A Tale Of Crowns Full